Explore Our Knowledge Categories

Dive into specialized glossaries across diverse topics

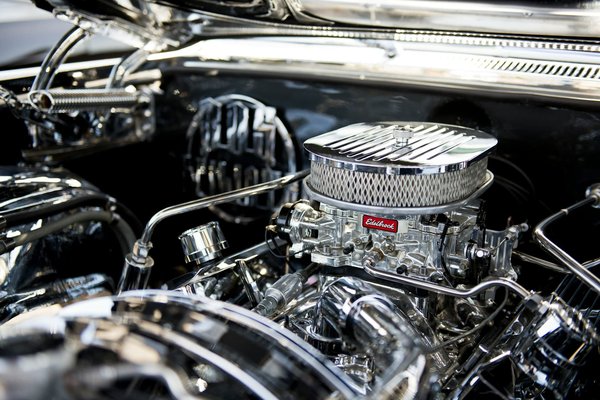

automotive

Cars, vehicles and driving

View articles →business

Business and economy

View articles →cooking

Recipes and culinary arts

View articles →finance & real estate

Finance, investment and property

View articles →health

Health, wellness and wellbeing

View articles →home & living

Home, decor and lifestyle

View articles →News

Latest news and current events

View articles →pets

Pets, animals and companions

View articles →sports

Sports, fitness and competition

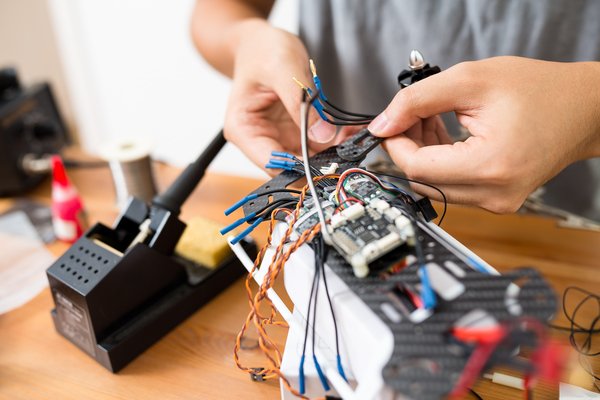

View articles →technology

Tech, gadgets and innovation

View articles →woman / fashion

Fashion, beauty and lifestyle

View articles →As a culinary student, I constantly reference Eeglossary for cooking terms. The definitions are precise and include helpful context that textbooks often miss. It's become my go-to resource during recipe development.

Latest articles

Our recent publications

Can a Performance Chip Tune Increase the Horsepower of a Ford Mustang EcoBoost Without Compromising Reliability?

Ever since the Ford Mustang burst onto the automotive scene in 1964, it has been the definition of American muscle. Fast...

How to Choose and Fit Performance Valve Springs in a Ford Mustang GT's V8 Engine?

In the world of high-performance automobiles, the Ford Mustang's prowess is undeniable. Its various models, including th...

How to Custom Mount a Front License Plate on a Tesla Model S Without Drilling the Bumper?

Custom mounting a front license plate on your Tesla Model S without drilling holes into the bumper is an easy task with ...

What's the Best Way to Achieve Optimal Gear Shifts with a Short Shifter in a Honda Type R?

For the uninitiated, the term 'short shifter' might seem like arcane car lingo. To those acquainted with the performance...

What's the Best Way to Install a Rear Spoiler on a Honda Civic for Improved Aerodynamics?

When it comes to vehicle modifications that not only add an edge of style but also improve the aerodynamics of your car,...

What's the Most Effective Way to Apply a Vinyl Wrap on a Tesla Model 3 for a Custom Look?

For many, a car is more than just a vehicle. It's a statement, an expression of personal style, and a reflection of indi...

Can Big Data Analytics Revolutionize UK Small Business Lending Models?

With the increasing rate of digitalization, the business landscape is changing. Today's businesses, especially small and...

How Can UK Home Improvement Brands Leverage Augmented Reality in Consumer Apps?

In the age of digital transformation, it's clear that technology is reshaping the retail landscape. One advancement that...

How to Develop an Inclusive Marketing Strategy for UK Multi-Ethnic Beauty Products?

In today's diverse and multi-cultural society, an inclusive marketing strategy is no longer a 'nice-to-have' but a neces...

How to Enhance the In-Store Retail Experience with Augmented Reality in the UK?

As the retail industry evolves in the UK, the integration of augmented reality (AR) technology into the shopping experie...

Maximise success with these best llc names

Choosing the right LLC name significantly impacts your brand's perception and customer engagement. A compelling name not...

What Are the Best Practices for Cybersecurity in Small to Medium UK Financial Institutions?

In this digital age, the ubiquity of cyber threats has become a constant source of concern for businesses. The financial...

What Are the Specific Legal Challenges for UK Drones Startups in Metropolitan Areas?

As the world keeps pace with the rapid technological advancements, drones, unmanned aerial vehicles, have emerged as a s...

Can You Bake a Gourmet Blueberry and Lemon Zest Clafoutis?

Imagine the sweet and tangy flavors of blueberries and lemon zest melding perfectly within a creamy, custard-like batter...

Can You Make Authentic Neapolitan Pizza in Your Home Oven?

Pizza is a universal love language. Whether you're a fan of the thin, crispy crust of a New York-style pie or the deep d...

How to Make a Delicate Rose Petal Jam for a Middle-Eastern Dessert?

Delicate, fragrant, and kissed with sweetness, rose petal jam is a staple in Middle Eastern cuisine. Used to top dessert...

What Are the Best Practices for Crafting a Gourmet Kale Caesar Salad with Homemade Croutons?

Creating a Gourmet Kale Caesar Salad with homemade croutons is an art that combines fresh ingredients, a perfect dressin...

What's the Best Method for Crafting Traditional Danish Smørrebrød?

It's a clear and sunny day in April. You're strolling down the cobbled streets of Copenhagen. The mouthwatering aroma of...

What's the Secret to a Tender and Flavorful Coq au Riesling?

Step into any French bistro, and you're bound to come across Coq au Vin. This classic French dish, featuring a tender ch...

How to Create Age-Friendly Urban Spaces that Enhance Elderly Mobility and Interaction?

As our global population continues to age, it becomes increasingly important to ensure that our cities and urban environ...

How to Design Real Estate Projects That Support Remote Work Trends in Rural Areas?

The rise of the remote work trend has significantly impacted various sectors, and real estate is no exception. As more p...

How to Incorporate Anti-Flood Measures in Coastal Property Developments in the UK?

In an era of increasing climate change, the risk of flooding is steadily escalating. The United Kingdom, with its extens...

How to Plan for Long-Term Maintenance in Seasonal Vacation Homes?

Whether you own a beachfront bungalow or a mountain cabin, a vacation home can be a source of numerous cherished memorie...

What Are the Implications of Automated Vehicles on Residential Parking Design?

In the thriving age of technology, automated vehicles (AVs) are rapidly becoming a reality. These self-driving cars, bui...

What Strategies Can Encourage the Adoption of Electric Cars in Suburban Real Estate Developments?

The adoption of electric vehicles (EVs) is no longer an abstract concept. It is a reality that is taking root and gainin...

Can Phytomedicine Be an Effective Complementary Treatment for Managing Menstrual Cramps?

When you delve into the worlds of scholarly articles and medical journals, you may often encounter complex terms and con...

How Can Community Gardens Influence the Social Determinants of Health in Low-Income Neighborhoods?

In the bustling metropolitan spaces that we inhabit, the concept of community gardens may seem somewhat novel. Yet, they...

How Does Exposure to Different Cultural Environments Affect Mental Flexibility and Creativity?

In an increasingly globalized world, individuals are more frequently exposed to varied cultural environments. Whether th...

How Does Exposure to Nature Films Influence Conservation Behaviors?

In today's rapidly advancing technological world, the power of media cannot be overstated. The media is a vital force in...

How Does Participating in Precision Sports Like Archery Improve Concentration and Mental Discipline?

Engaging in sports can be an effective way to enhance mental and physical health. One such sport, archery, requires not ...

Frequently Asked Questions

What makes Eeglossary different from other glossary sites?

Eeglossary focuses on three core areas—automotive, business, and cooking—with expert-verified definitions. Each entry includes practical context and real-world examples, making complex terminology accessible to both beginners and professionals. Our content is regularly updated to reflect current industry standards and emerging terminology.

How often is new content added to the glossaries?

We update our glossaries weekly with new terms, revised definitions, and expanded entries. Our editorial team continuously monitors industry trends and reader requests to ensure our content remains relevant and comprehensive. You can subscribe to our newsletter to stay informed about the latest additions.

Can I suggest terms to be added to the glossaries?

Absolutely! We welcome suggestions from our readers. If you encounter a term that isn't in our glossaries or believe an existing definition could be improved, you can submit your suggestion through our contact form. Our editorial team reviews all submissions and prioritizes those most requested by our community.

Are the definitions suitable for complete beginners?

Yes, our glossaries are designed to be accessible to readers at all knowledge levels. We write definitions in clear, straightforward language while maintaining technical accuracy. Complex terms include additional context and examples to help beginners understand, while still providing the depth that professionals appreciate.